Key Takeaways

- Inflation has consistently grown for 19 months until July 2024.

- Businesses are constrained by the rising cost of inputs.

- Government at the national and subnational levels have deployed numerous interventions to support businesses in Nigeria.

- Entrepreneurs need to embrace numerous price and technology-related strategies among others to stay above the effect of inflation.

Introduction

The macroeconomic environment in recent times has exposed businesses to different challenges. Top of the list is inflation occasioned by the twin policy action of the Federal Government in 2023; the Premium Motor Spirit (petroleum) subsidy removal and the unification of the exchange rate windows.

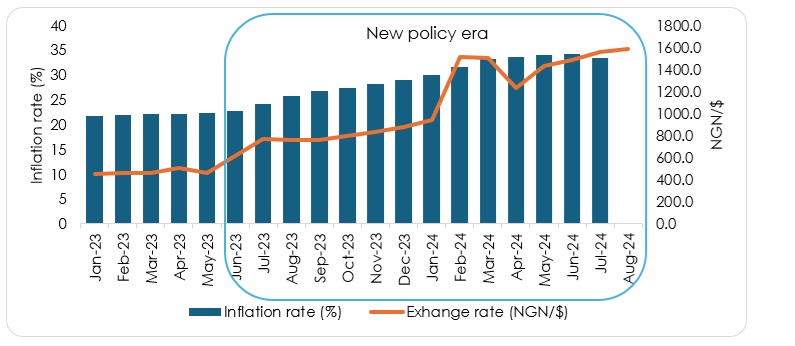

Figure 1: Inflation and Exchange rates (Jan 2023 - Aug 2024)

Source: Central Bank of Nigeria; LSETF Research

The inflation rate increased 10.61% from 22.79% in June 2023 to 33.4% in July 2024. The trend slowed in July 2024, the first time in nineteen months, after reaching a 28-year high in June 2024. The trend has consistently reduced the purchasing power of consumers as commensurate increase in earnings is non-existent. This has further strained businesses, emphasising the need for shrewd management and government intervention.

While the Federal Government, through the Central Bank of Nigeria, has increased the monetary policy rate as a means of curbing inflation, it also launched grant and loan initiatives to support businesses. At the subnational level, the Lagos State Government, through the Lagos State Employment Trust Fund, has maintained consistent support for businesses through single-digit interest loans and grants as well as business support initiatives for entrepreneurs. Beyond these, we have highlighted some strategies to help you stay above inflation and potential stagnant growth and uncertainty that businesses encounter in this period.

Strategies for Managing Costs and Profitability

These are practical strategies to help you navigate these challenges and maintain profitability.

- Monitor and Adjust Pricing

Regularly review your pricing strategy to ensure it reflects current costs. Periodic monitoring of prices in the market enables you to determine how to adjust your pricing model. In some contexts, you can consider small price increases. In others, bundle pricing, which enables you to sell multiple products as a bundle at once at a slightly discounted price might be the better option. Using bundle pricing, you can combine products of complementary nature or the same category for sale at once. For example, selling a dozen or half-dozen of a product rather than in units at a slightly discounted rate.

- Avoid Over-projection

While Monetary value increases due to inflation i.e. the numerical cost of items, the true value of goods stays the same. Seasoned business owners are able to identify the impact of inflation rather quickly, however, for new business owners/entrepreneurs, it is advisable to consider the inflation influence on business growth and to identify what ‘growth’ percentage inflation is responsible for. This allows effective scaling and planning.

- Optimize Supply Chains

Cutting your operating expenses may be the missing link to your profitability in this period. For businesses with reliance on imported products amid exchange rate volatility, build relationships with local suppliers to reduce dependence on imported inputs. This enables you to lower costs by negotiating better prices while considering nearshoring or reshoring.

- Improve Operational Efficiency

Using papers and incurring transportation costs to deliver documents and other activities that could be completed through automation need to be identified and optimised. As a result, it is important to streamline processes as much as possible, automate where possible, and reduce waste. Investing in digital tools and digitalisation to enhance productivity.

- Manage Inventory Effectively

Implement just-in-time inventory management to minimize holding costs. Use simple inventory management tools to track stock levels.

- Diversify Revenue Streams

Explore new markets, products, or services to reduce dependence on a single revenue source. It is important that you ensure to possess the requisite knowledge to run such additional businesses.

- Invest in Cost-Saving Technologies

Leverage affordable technologies like energy-efficient equipment or digital marketing tools to reduce costs.

- Leverage funding opportunities

Be on the lookout for funding opportunities that can be leveraged for your business. Numerous opportunities to access grants and loans from development organisations, government establishments, not-for profit actors and the private sector, with favourable conditions.

Conclusion

Entrepreneurs are faced with challenges imposed by the rising cost of inputs. While the government at the national and sub-national levels continues to roll-out interventions to curtail the inflationary trend, businesses must implement strategies such as price monitoring and adjustment, avoidance of over-projection, optimize supply chains, diversify their income streams by widening their product portfolio and leveraging government interventions. By implementing these strategies, MSMEs can better navigate the challenges of inflation and stagflation, ensuring profitability and resilience in uncertain times. Stay updated with intervention programmes from LSETF by signing up for our newsletter.